A solution purpose-built for the enterprise

With MessageGears, you can do pretty much anything you can think about, and the technology just gets out of the way. It’s genuinely changed what we can do as a company.

Mark Stange-Tregear

VP Analytics at Rakuten

Picture those campaigns you’ve put on the shelf because they’re too hard to execute with your current tech. MessageGears is built to eliminate those roadblocks – if you can dream it, you can do it.

Everyone’s going to tell you they provide “real time” data access. But MessageGears is the only customer engagement platform that directly accesses your data. Period.

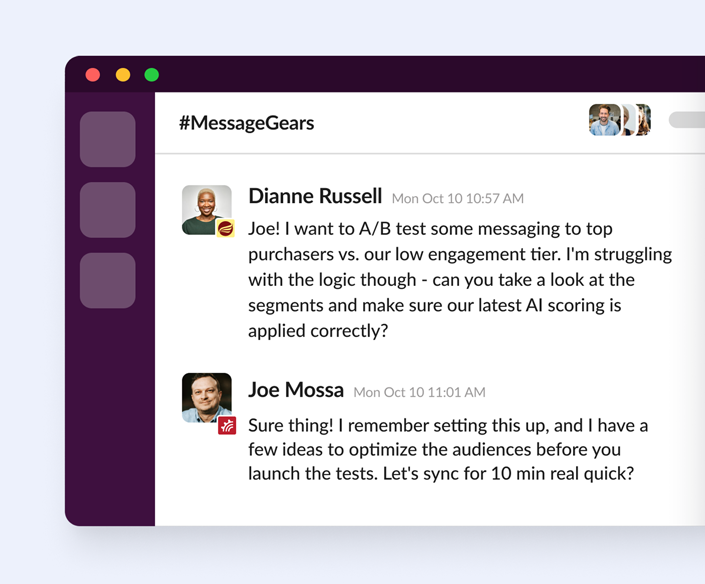

The stakes are too high for you to be stuck in a slow support queue. Find out what true partnership looks like with a team dedicated to your success. Our support functions just like our platform – without limits.

THE MESSAGEGEARS PLATFORM

Execute the cross-channel customer experience you’ve always dreamed of delivering – without all the roadblocks